In relation to payment to be made by You on or after 1 July 2018 of fee for offshore digital services provided by Google Asia Pacific Pte Ltd Google Ireland Ltd a 5 tax is applicable in accordance with the provisions of Pakistan Finance Act 2018. Where applicable You may need to deposit this tax in accordance with Google Ads program Terms and Conditions under which.

When And Where To File Your Tax Return In 2018

Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

. Issue 77 - 6 July 2018 Passage of expanded deduction for purchase of intellectual property rights. Malaysia is separated into two landmasses by the South China Sea. The deadline for filing paper tax returns was midnight on 31 October 2021.

The users of the e-filing portal had experienced difficulties when it was launched on June 7 last year and since then it has seen glitches happening on and off. Central Goods and Services Act 2017. Issue 76 - 13 June 2018 Tax measures introduced to relieve individual tax burden and provide tax incentives for environmental protection and bond market.

Issue 75 - 30 May 2018 Hong Kong. Experts suggest taxpayers shouldnt wait for too long. See the Branch income section for a list of countries and territories considered as tax havens by the tax authorities.

Tax Filing In Germany For International Students Quick Facts. Find out how and why you can submit your 20222021 Self Assessment tax return by midnight on 28 February 2022 without incurring a penalty. The deadline for filing taxes for the year 2018 is on the 31 st of May 2019.

1 online tax filing solution for self-employed. Beginning with the 2019 tax year the IRS allows you to e-file amended tax returns if you filed the original return electronically and provided that your tax software supplier supports electronically filing amended returns. The deadline for ITR filing AY 2022-23 is July 31.

Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e. A student can ask for an extension if they are unable to file a tax return on time but youll have to pay an amount as a penalty. Rs 25 Total late fees to be paid per day.

The online deadline is midnight on 31 January 2022. The income tax slabs and rates have been kept unchanged since financial year FY 2020-21. The western landmass known as Peninsular Malaysia is bordered to the north by Thailand and to the south by Singapore while the eastern landmass East Malaysia is bordered by Brunei and Indonesia.

Companies with taxable revenues that exceed 1 million United States Dollars USD in 2018 must pay an annual contribution in 2020 2021 and 2022. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. Name of the Act Late fees for every day of delay.

According to a tweet from the. An important gateway to lucrative regional markets Malaysia has a developed economy that has grown over the past. File your tax returns at the local tax office based on your.

Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. How To Get Germany Dependent Visa. For FY 2021-22 and 2022-23 individual taxpayers will continue to choose between two tax regimes - the existing or old tax regime and the new.

Self-Employed defined as a return with a Schedule CC-EZ tax form. The contribution rate ranges from 010 to 020 and must be calculated. The online deadline is midnight on 31 January 2022.

Online competitor data is extrapolated from press releases and SEC filings. The time for the filing of income tax return for the assessment year 2022-23 has arrived. For all other back taxes or previous tax years its too.

Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017. To amend a return for 2018 or earlier youll need to print the completed Form 1040-X and any other forms youre amending. Tax reserve certificate for tax in dispute.

Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline. There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022-23 in Union Budget 2022. In the case of salaried taxpayers and non-auditable cases the filing deadline for ITRs for the AY 2022-23 is 31 July 2022.

Entities subject to UK corporation tax include UK companies non-UK companies with a UK. Companies and other entities subject to corporation tax are required to file their corporation tax return by the relevant anniversary of their accounting reference date for all relevant corporation tax accounting periods. Corporation tax return filing Deadline for action.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Income Tax Malaysia 2018 Mypf My

Pdf Application Of Hec Ras And Arc Gis For Floodplain Mapping In Segamat Town Malaysia

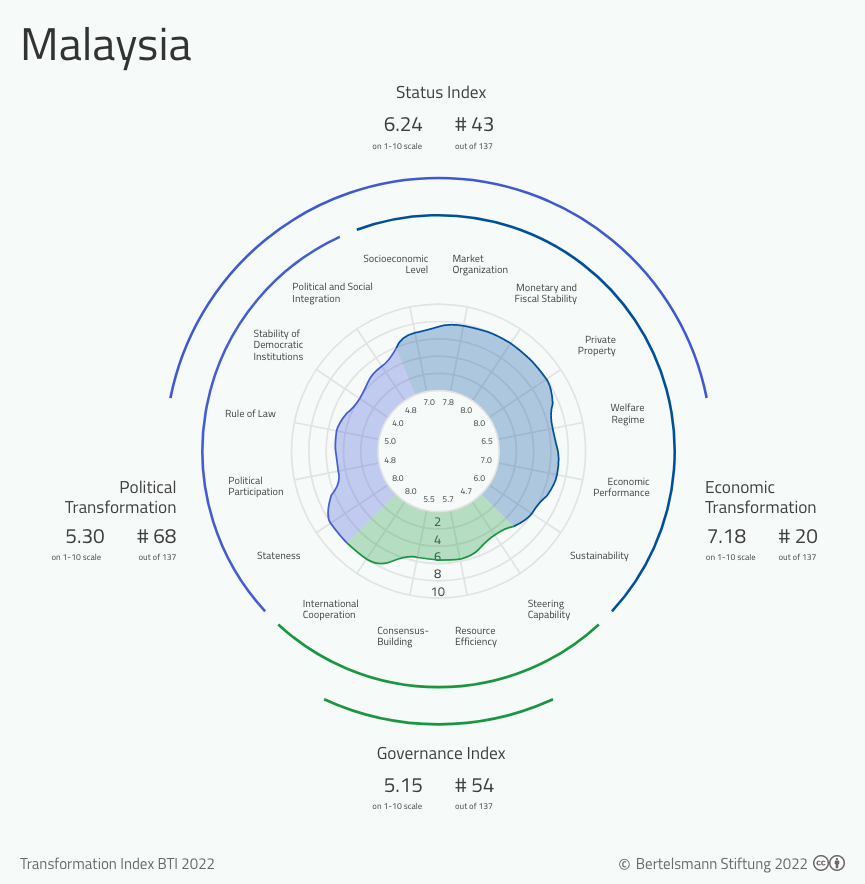

Bti 2022 Malaysia Country Report Bti 2022

Maldives Fixed Departure Singapore Tour Singapore Tour Package Maldives

Namibia Revenue Agency Namra Org Na Twitter

Do You Need To File A Tax Return In 2018

Pdf The Effect Of Digital Banking Service Quality On Customer Satisfaction A Case Study On The Malaysian Banks

Diwali Dhamaka Offer Ava Vacations Singapore Tour Singapore Tour Package Vacation

Income Tax Malaysia 2018 Mypf My

Malaysia S 100 Leading Graduate Employers 2018 19 By Gti Media Asia Issuu

Malaysia S Richest 2018 Genting Gaming Family Fighting Over The Chips

Income Tax Malaysia 2018 Mypf My

Pdf The Impact Of Board Independence And Foreign Ownership On Financial And Social Performance Of Firms Evidence From The Uae

Don T Lose Your 2018 Tax Refund Forever 1 5 Billion Reasons To Act Now

Pdf Modeling Crowdfunders Behavioral Intention To Adopt The Crowdfunding Waqf Model Cwm In Malaysia The Theory Of The Technology Acceptance Model

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My